MIXED PAYMENT TO INCREASE LOYALTY PROGRAM ATTRACTIVITY

Loyalty programs have long relied on rewards and redemptions to keep members engaged, but a frustrating reality persists: too often, accrued points go unused. For industries like airlines, travel, and transport, where customer engagement and retention are mission-critical, addressing this pain point is essential. One innovative solution gaining traction is mixed payment—a payment method that combines loyalty currency (points, miles, or credits) with cash currency.

This blog explores the concept of mixed payment, its benefits, and how loyalty programs can implement it effectively. By the end, you’ll see how mixed payment can unlock greater value for both businesses and customers while improving loyalty program relevance, engagement, and ROI.

WHAT IS MIXED PAYMENT?

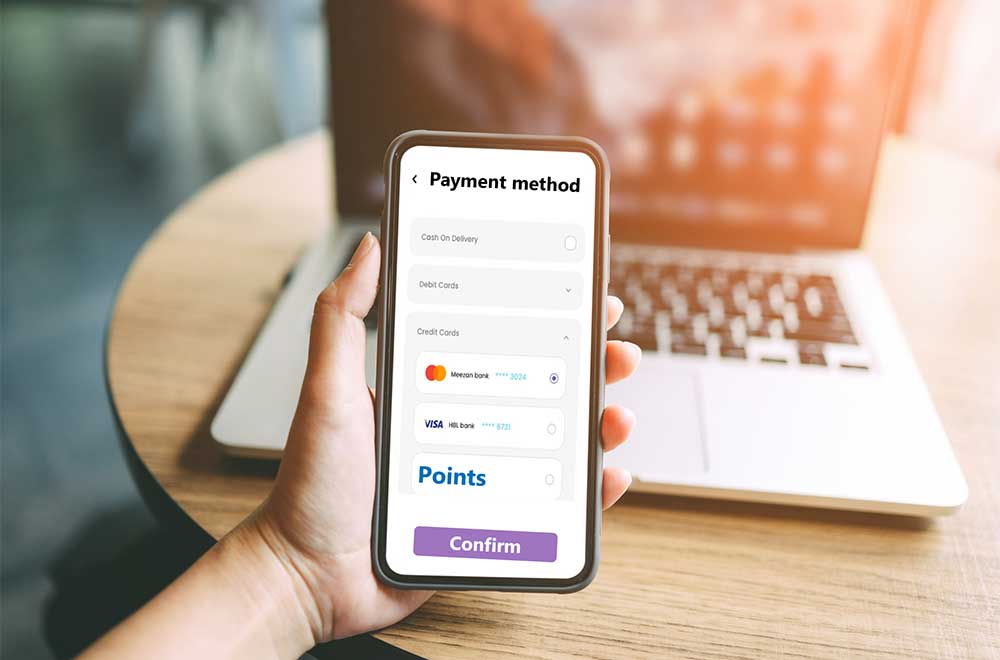

Mixed payment refers to the ability for customers to pay for goods, services, or rewards using a combination of loyalty currency (e.g., miles or points) and cash or card payments. This hybrid approach brings flexibility into the redemption process, alleviating common roadblocks customers face when they don’t have sufficient loyalty points to cover a full transaction or redeem for relevant rewards.

Also known as “points plus cash” or “split payments,” this concept empowers members to “top up” their points with cash, or top up their cash with points, enabling partial redemptions and making rewards more accessible.

Giving members the ability to personalize their tier benefits creates a sense of ownership and exclusivity. When travelers can choose the perks that matter most to them, they feel more connected to the program and the airline. This leads to greater engagement, higher satisfaction, and stronger long-term loyalty. Rather than applying a blanket approach to rewards, allowing members to tailor their own benefits fosters a deeper emotional connection with the brand.

EXAMPLES OF MIXED PAYMENT METHODS

Mixed payment methods are becoming increasingly popular across industries:

- Airline Industry – Travelers might use 50% of the required miles for an award ticket and pay the balance in cash.

- Hospitality – Hotel guests can redeem part of their loyalty points to offset a room booking.

-

E-commerce – Certain online retailers allow members to pay partially in loyalty points and partially from their wallet at checkout.

PAIN POINTS ADDRESSED BY MIXED PAYMENT

Loyalty marketers know that redemption friction can lead to wasted opportunities and inactive loyalty members. Here’s how mixed payment addresses key challenges.

Low Redemption Rate

High Redemption Threshold

Perception That Points Are Useless

Relevance Of The Loyalty Program

When members cannot easily redeem their points, they may perceive the loyalty program as irrelevant, reducing their engagement and participation. By offering mixed payment options, loyalty programs can demonstrate their commitment to providing value and flexibility to their members. This can help to re-engage members and reinforce the relevance of the loyalty program.

BENEFITS OF MIXED PAYMENT

Implementing mixed payment isn’t just good for your customers—it delivers measurable benefits to loyalty programs, too.

Increased Payment Flexibility

- Combining Loyalty and Cash Currencies – Mixed payment models give customers the flexibility to maximize the use of their loyalty points while balancing their personal cash spending. For example, a passenger can redeem 15,000 miles for a $450 ticket instead of needing the full 25,000 miles, paying the $150 difference in cash instead.

-

Adapting to Customer Needs – Consumers demand frictionless, personalized experiences, and flexibility in payment options aligns perfectly with those expectations. Mixed payment enables businesses to cater to diverse customer preferences while enhancing their journey.

Enhanced Customer Experience and Loyalty Program Relevance

- Convenience and Ease of Use – Mixed payment removes the barriers to redemption by making transactions seamless and approachable. Customers no longer need to stress over earning enough points—they simply use what they have and pay the rest in cash.

-

Building Customer Loyalty – Offering mixed payment options builds goodwill by showing program members you value their loyalty and want to make their experiences rewarding. The combination of increased redemption opportunities, reduced frustration, and added convenience strengthens customer relationships and improves retention.

HOW TO IMPLEMENT MIXED PAYMENT

Successfully introducing mixed payment into your loyalty program requires careful planning and execution. Here’s how you can get started:

Assessing Your Business Needs

Understand Customer Preferences

A successful mixed payment model requires insights into the behaviors and expectations of your customers. Gathering feedback through surveys, analytics, and customer interactions can guide the design process.

Evaluate Current Payment Processes

To integrate mixed payment, assess the existing payment infrastructure. Consider enhancements to your payment systems, such as APIs for loyalty currency calculations or partnerships with fintech providers that specialize in hybrid payment solutions. The payment itself and the ratio between cash and loyalty currency should be as flexible as possible.

Choosing the Right Concept for Mixed Payment

Currency Conversion Concepts

Develop a transparent and straightforward conversion policy to enable seamless hybrid payments. For example, convert $1 of cash value into 100 points or define tiers and thresholds for combining miles and cash payments. Ratios may also be different by product.

Handling Refunds

Conclusion

As digital wallets, alternative currencies, and real-time payment solutions evolve, the concept of mixed payment will continue to play a vital role in shaping loyalty strategies.

Mixed payment offers a flexible and convenient way to enhance your loyalty program’s effectiveness by:

- Increasing redemption rates

- Increasing interactions with the program

- Reducing barriers to meaningful rewards

- Improving the perceived relevance and value of the program

At LPS, we specialize in helping businesses design innovative loyalty solutions that drive engagement and ROI. Our cutting-edge technology and expert consulting services can help identify the optimal approach to implementing mixed payment in your loyalty program.

Ready to elevate your loyalty strategy?

Contact us today to discover the transformative potential of mixed payment in your business.